Workers' Accident Compensation Insurance is a crucial component of Japan's social security system. It provides financial support and medical care to employees who suffer work-related injuries, illnesses, or deaths.

First Published: 2020-10-26

Updated: 2024-08-01

Table of Contents

- What is Workers' Accident Compensation Insurance?

- Coverage of Workers' Accident Compensation Insurance

- Benefits Provided by Workers' Accident Compensation Insurance

- Who Are Covered by Workers' Accident Compensation Insurance

- How to Make a Claim for Workers' Accident Compensation Insurance

- Beware of Rousai Kakushi (労災隠し)

- Find a Job in Japan with WeXpats

Are you having any issues with job-hunting in Japan?

Are you having any issues with job-hunting in Japan?

What is Workers' Accident Compensation Insurance?

Workers' Accident Compensation Insurance, also called “Industrial Accident Compensation Insurance”, is 1 out of 5 crucial components of Japan’s social insurance. The others are health, pension, employment and nursing insurance, which you can read about here in our social insurance (社会保険, Shakai Hoken) article.

Workers' Accident Compensation Insurance is commonly known as 労災保険 (Rousai Hoken) in Japanese, the abbreviation of 労働者災害補償保険 (Roudousha Saigai Hoshou Hoken). It is known as collectively as Labour Insurance (労働保険, Roudou Hoken) together with Employment Insurance (雇用保険, Koyou Hoken).

Workers' Accident Compensation Insurance provides financial support and medical care to employees who suffer work-related injuries, illnesses or deaths. Any business that hires employees, even if there’s only one employee, must enroll in Workers' Accident Compensation Insurance. It is mandatory for all workers employed by a company including part-time and temporary workers. The insurance premium is fully covered by the employer.

Writer's Pick

Coverage of Workers' Accident Compensation Insurance

Coverage of the Workers' Accident Compensation Insurance can be broadly divided into 2 categories:

- Employment Injury (業務災害, Gyoumu Saigai)

- Commuting Injury (通勤災害, Tsuukin Saigai)

Employment Injury (業務災害, Gyoumu Saigai)

An industrial injury, or employment injury, refers to an injury, illness, disability or death that a worker suffers as a result of work. Even if it is during working hours, personal actions unrelated to work are not considered as industrial injury.

Examples of Industrial Injury include:

- Hit by falling objects at company warehouse or construction site

- Slipping and falling from wet surface at work or client’s office

- Injured by by collapsed structure while on a business trip

- Developing depression as a result of working overtime for over 100 hours a month for over 6 months

Commuting Injury (通勤災害, Tsuukin Saigai)

A commuting injury refers to an injury, illness, disability or death that a worker suffers during commute for work. This includes commute to and from work and home, commute from one workplace to another workplace, and commute to and from work and assigned location for work.

Benefits Provided by Workers' Accident Compensation Insurance

The benefits and amount provided depends on the type of compensation to be claimed. Below are the types of benefits available through the Workers' Accident Compensation Insurance.

Information from this part is taken from the Ministry of Health, Labour and Welfare’s “Brochure about Workers' Accident Compensation Insurance for Foreign Workers” available here. The brochures are available in various languages including Japanese, English, Chinese, and Korean.

Medical (Compensation) Benefit

For medical treatment of injuries and illnesses.

Free medical treatment at designated workers’ accident hospitals and medical institutions, or reimbursement of paid medical expenses if treatment received elsewhere.

Claims must be submitted within 2 years from the following day of payment.

Temporary Absence from Work (Compensation) Benefit

When unable to work and receive wages in order to receive medical treatment for injury or illness.

This benefit can be received from the 4th day of absence from work. The amount of benefit is 80% of the basic daily benefit (*) per day which is made up of 60% insurance benefit and 20% special allowance.

Claims must be submitted within 2 years from the following day wages are no longer received.

(*) Basic Daily Benefit (基礎日額) is daily wage amount calculated by dividing the total past 3 months’ basic wages before the injury or illness was incurred by the number of calendar days.

Disability (Compensation) Benefit

Disability remains after recovery from a work-related injury or illness.

Compensation differs depending on categorisation of disability.

Claims must be submitted within 5 years from when injury / illness is recovered.

【Class 1~7 Disability】

Eligible to receive disability pension, lump-sum disability special allowance and disability special pension. The amount of disability pension receivable depends on Class Type, with Class 1 receiving the most benefits (313 days of basic daily benefit payment(*) for disability pension) and Class 7 receiving the least (131 days of basic daily benefit payment(*) for disability pension).

The amount of lump-sum disability special allowance is between 3.42 million to 1.59 million yen, and the amount of disability special pension is between 313 to 131 days of basic daily calculation(**) amount.

【Class 8~14 Disability】

Eligible to receive lump-sum disability compensation, disability special allowance and disability special lump sum. The amount of lump-sum disability compensation receivable depends on Class Type, with Class 8 receiving the largest amount (305 days of basic daily benefit(*) payment) and Class 14 receiving the smallest amount (56 days of basic daily benefit(*) payment).

The amount of disability special allowance is between 650,000 to 80,000 yen, and the amount of disability special lump sum is between 503 to 56 days of basic daily calculation(**) amount.

For the exact benefit amounts for all classes of disabilities, refer to the table available on Page 11 of the Industrial Accident Compensation Insurance Application Guidance for Foreign Workers < Volume 1 > by the Ministry of Health, Labour and Welfare here.

(*) Basic Daily Benefit (基礎日額) is daily wage amount calculated by dividing the total past 3 months’ basic wages before the injury or illness was incurred by the number of calendar days.

(**) Basic Daily Calculation Amount is calculated by dividing the total amount of special payments received for 1 year prior to injury, illness or death by 365. Special payments include bonuses and other wages which are excluded from calculation of Basic Daily Benefit amount.

Injury and Disease (Compensation) Benefit

When a year and a half (1 year 6 months) has passed since the injury/illness or medical treatment has begun, yet the injury/illness has not recovered or a disability has developed as a result of the injury/illness, then this benefit can apply. The injury or disease has to fall within the legally designated injury and disease classifications and the condition needs to be continuous for this benefit to apply.

There are 3 classifications for injury/disease. The amount receivable is subject to classification. Benefits consist of injury/disease compensation, lump-sum injury/disease special allowance, and injury/disease special pension.

No time limit for claim is specified.

Nursing Care (Compensation) Benefit

For the nursing care expenses of recipients of disability (compensation) and pension/injury (compensation) benefits. Nursing care includes post-surgical treatment, aftercare, assistive devices, prosthetics, etc. expenses.

Certain conditions need to be fulfilled to claim this benefit:

-

Designated class of disability that requires nursing care.

-

Receiving nursing care from a private nursing care service, family or acquaintance.

-

Not currently hospitalised.

-

Not currently admitted to a nursing care or elderly healthcare facility.

Benefit amount depends on the type of nursing care service - whether constant or on-call, and whether provided by a private service or family/friend/acquaintance.

【Constant Nursing Care】

The maximum amount provided is 172,550 Yen.

If receiving nursing care from family, friends or acquaintances and no expense is incurred, then 77,890 yen will be paid. If expense is incurred, then 77,890 yen will be paid if expenses less than 77,890 yen.

【On Call Nursing Care】

The maximum amount provided is 86,280 Yen.

If receiving nursing care from family, friends or acquaintances and no expense is incurred, then 38,900 yen will be paid. If expense is incurred, then 38,900 yen will be paid if expenses are less than 38,900 yen.

Claims must be submitted within 2 years of the first day of the month following the month nursing care was received.

Surviving Family (Compensation) Benefit

When a work-related death occurs, the bereaved family is eligible to receive this benefit.

The bereaved family can claim compensation pension for surviving family (by number of surviving family members), lump-sum of 3 million yen, and special pension for surviving family. The amount of benefit claimable depends on the number of surviving family members.

Family members eligible to claim this benefit include spouse, child, parent, grandchild, grandparent and sibling who are dependent on the deceased for their livelihood. Apart from the spouse, other family members must satisfy other conditions such as being below or above a certain age limit or suffering from a designated class of disability to claim the benefit.

Claims must be submitted within 5 years after the deceased passed away.

Funeral Expenses Benefit

For the surviving family who holds a funeral for the deceased, or a company funeral held for the deceased.

Benefit of lump-sum 315,000 yen and 30 days of basic daily benefit(*) is provided. Or, if the total amount for funeral expenses is less than that, then 60 days of basic daily benefit(*).

(*) Basic Daily Benefit (基礎日額) is daily wage amount calculated by dividing the total past 3 months’ basic wages before the injury or illness was incurred by the number of calendar days.

Claims must be submitted within 2 years after the deceased passed away.

Calculation of Workers' Accident Compensation Insurance Premium

Workers' Accident Compensation Insurance premiums are fully covered by the company. The amount is calculated by multiplying the total amount of employees’ wages by the workers’ accident compensation insurance rate.

The applicable rate is determined according to the type of business the company is running. The list of rates is available on the MHLW’s website, the latest rate is here (as of 2024).

Who Are Covered by Workers' Accident Compensation Insurance

As previously mentioned, as a general rule, all workers including part-time and temporary workers are covered under the Workers' Accident Compensation Insurance. However, there are some people who are not covered under Workers' Accident Compensation Insurance.

Who is covered under Workers' Accident Compensation Insurance?

- All ordinary employees including part-time, temporary, seasonal workers

- Dispatch workers (by the dispatch company)

- Employees on overseas business trips

Who is not covered under Workers' Accident Compensation Insurance?

- Company executives who represent the company or are authorised to execute business on behalf of the company (exceptions apply depending on job scope)

- Self-employed / Freelancers (because they are not employees)

- Employees dispatched overseas (special enrolment required)

- Family workers (exceptions apply)

Special Enrolment (特別加入) for Workers' Accident Compensation Insurance

A special voluntary enrolment system exists to allow non-workers who are deemed eligible to enrol in Workers' Accident Compensation Insurance. Those eligible are broadly divided into 4 categories:

- Small and Medium-sized Business Owners

- Sole Proprietors

- Those Engaged in Specific Work

- Workers Dispatched Overseas

Examples of “Sole Proprietors” and “Those Engaged in Specific Work”

- Taxi Drivers

- Delivery Person

- Animators

- IT Freelancers

- Fisherman

- Foresters

- Farmers

- Massage therapist, acupuncturist

From November 2024, the scope of freelance workers eligible for voluntary Workers' Accident Compensation Insurance will expand to all industries. The move to expand the scope is because of the high number of freelancers in Japan as revealed in a government survey. Until now, the scope of the special voluntary system has been expanding sector by sector with animators, bicycle delivery workers and IT freelancers added in 2021, and dental technicians in 2023.

For more details including eligibility conditions and application procedures, check the MHLW’s site here.

※ MHLW, “令和6年11月から「フリーランス」が労災保険の「特別加入」の対象となります”

How to Make a Claim for Workers' Accident Compensation Insurance

To make a claim under Workers' Accident Compensation Insurance, you will need to fill-in and submit a claims form to the Labour Standards Inspection Office along with supporting documents. It is also possible to submit a claim through your company. What claim form and what supporting documents are required depends on the compensation benefit you are applying for. For example, a death certificate of the deceased is required for claims for funeral expenses and surviving family (compensation) benefit.

The procedure for claims generally goes like this:

- Work-related injury, illness or death occurs

- Medical treatment is received

- Submit insurance claims form and supporting documents to Labour Standards Inspection Office

- Examination by Labour Standards Inspection Office

- Determination of whether benefits will be provided

- Benefits are transferred to specified bank account

The most important thing to bear in mind is the time limit, or statute of limitations, for claims. If you miss the deadline, you will not be able to make a claim.

A list of all the Labour Standards Inspection Office is available here (MHLW). If you have problems or inquiries about claims, you can contact the Labour Bureau’s Hotlines that offers consultation and counselling in foreign languages (check here).

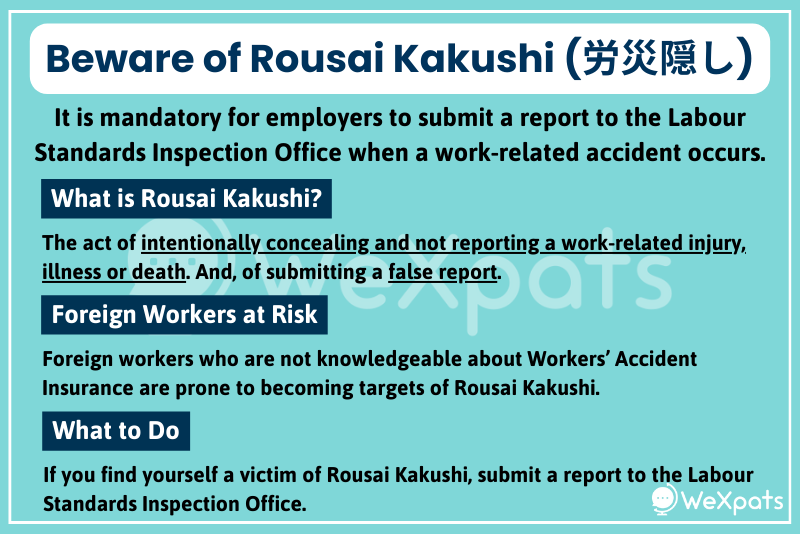

Beware of Rousai Kakushi (労災隠し)

What is Rousai Kakushi (労災隠し)?

It is mandatory for employers to submit without delay a report to the Labour Standards Inspection Office when a worker suffers a work-related injury, illness or death. 労災隠し (Rousai Kakushi) is the act of intentionally concealing and not reporting a work-related injury, illness or death. Submitting a false report also counts as Rousai Kakushi.

Rousai Kakushi is illegal. Foreign workers who are not knowledgeable about Workers’ Accident Insurance are prone to becoming targets of “労災隠し (Rousai Kakushi) - when a company conceals a workplace accident to avoid insurance claim”, so practice caution. If you find yourself a victim of Rousai Kakushi, submit a report to the Labour Standards Inspection Office.

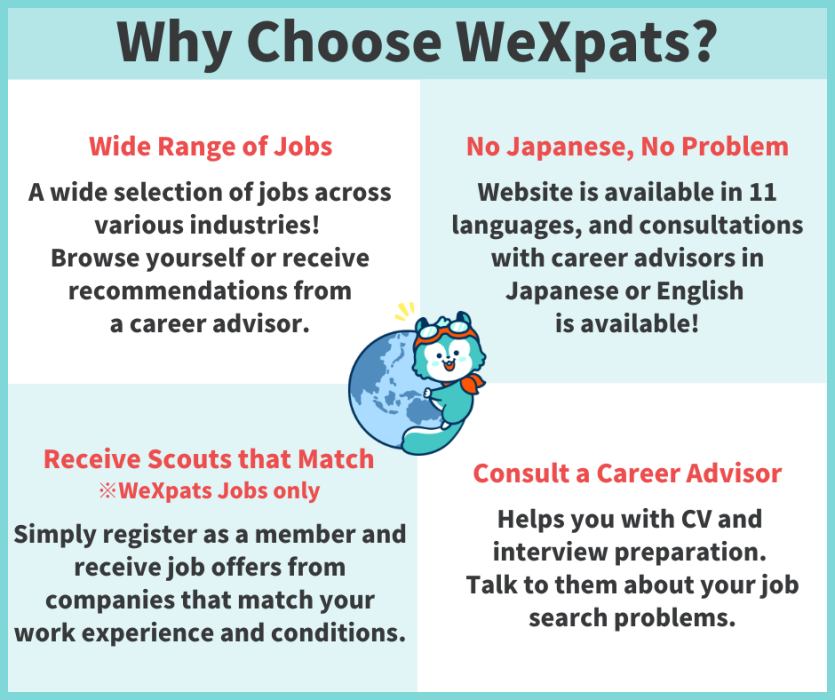

Find a Job in Japan via WeXpats

WeXpats operates a service for foreign nationals who want to work in Japan. There are jobs in a variety of industries including human resource and recruiter jobs. There are 2 services available on WeXpats - WeXpats Agent for full time jobs and WeXpats Jobs for part time jobs.

Looking for a Full Time Position? Leave it to WeXpats Agent!

WeXpats Agent is a career support service that specialises in employment for foreign nationals living in Japan.

Recruitment agencies in Japan are a service where dedicated career advisors will assist you with your job hunt for free. In addition to introducing open positions, we also provide support to help you create your Japanese resume and practice for interviews. Worried about job hunting in Japanese? We are here for you.

Features of WeXpats Agent

-

We have many job openings that are a good fit for foreign nationals to work in, such as translation, interpretation, inbound, etc. jobs that make use of your language skills, as well as engineering etc. jobs that do not require Japanese skills.

-

Our career advisors support and help you prepare your resume and practice job interviews with you. Clearly communicate your strengths to the hiring company.

-

We will handle communication with companies on your behalf, such as arranging interview dates and negotiating conditions. And thereby reducing your stress and time spent.

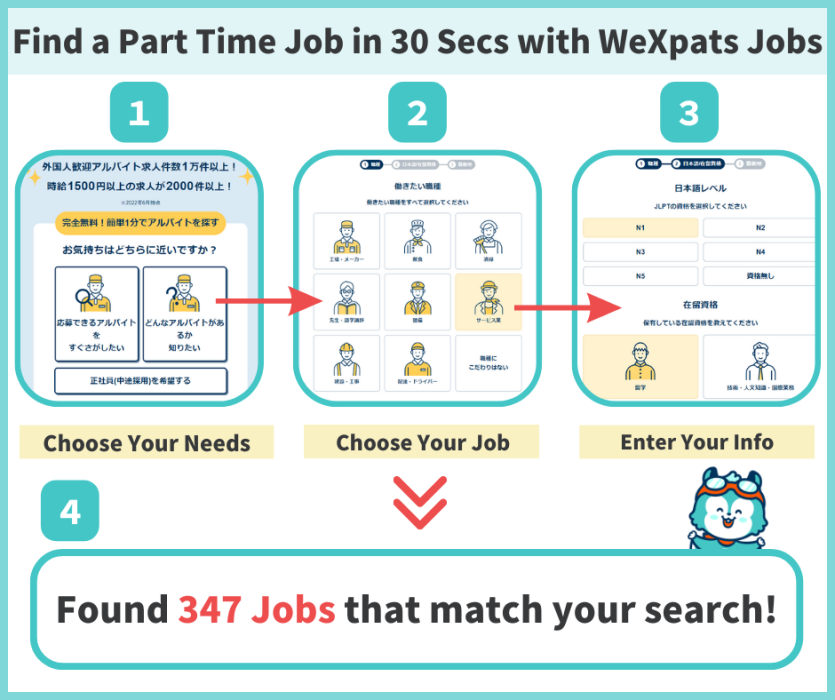

Finding a Part Time Job? Browse on WeXpats Jobs!

WeXpats Jobs is a part time job site for foreign nationals living in Japan. You can search for jobs in 11 languages (English, Vietnamese, Korean, Indonesian, Traditional Chinese, Simplified Chinese, Burmese, Thai, Spanish, Portuguese), including Japanese. Find jobs that suit you by specifying your Japanese language level, occupation, location, and etc.

※ You can register from outside Japan, but only those living in Japan can apply for jobs.