Aspiring to become an accountant in Japan? Basics of accounting is quite standard around the world, which is why foreign accountants may find it easy to work internationally, and even in Japan. To work as an accountant in Japan, a background in accounting or finance is typically required, as well as Japanese language proficiency.

First Published: 2021-07-12

Updated: 2024-04-16

Table of Contents

- A Look at the Accounting Industry in Japan

- Accountant Jobs in Japan for Foreigners

- Workplace Options for Accounting Jobs in Japan

- Requirements for an Accountant Job in Japan

- How to Become a Professional Accountant in Japan

- Accountant Salary in Japan

- Accountant Visa in Japan

- Find a Job in Japan with WeXpats

Are you having any issues with job-hunting in Japan?

Are you having any issues with job-hunting in Japan?

A Look at the Accounting Industry in Japan

The role of accountants is vital in society, especially for business, economy and investment heavy countries like Japan. The more businesses and companies a city or country has, the more accountants are in demand.

For Japan, who is one of the biggest economic centres in the world with many international business relationships, there is a great need for accountants with foreign language skills and foreign accounting standards.

Japanese Accounting Standards

The Accounting Standards Board of Japan (ASBJ) decides on what accounting standards are acceptable in Japan. At present, the 4 applicable accounting standards are:

- Japanese Generally Accepted Accounting Principles (J GAAP)

- US Generally Accepted Accounting Principles (GAAP)

- International Financial Reporting Standards (IFRS)

- Japan's Modified International Standards (JMIS)

Japanese companies can choose any one of the accounting standards to follow. Small to medium companies usually pick J GAAP, and companies with frequent dealings with the US will usually choose GAAP.

※ The Japanese Institute of Certified Public Accountants (JICPA), "Accounting Standards"

More About IFRS

The IFRS was adopted in Japan back in 2010. Due to the strict eligibility criteria, companies were reluctant to use IFRS. In response, the Financial Services Agency (FSA) amended the relevant Cabinet Office Ordinances to make it simpler to satisfy the criteria in an effort to increase the usage of IFRS.

It seems that the plan worked as according to the EU-Japan Centre for Industrial Cooperation, as of 2019 over 30% of companies listed under Tokyo Stock Exchange are using or plan to use the IFRS standard. It is expected that the numbers will continue to increase.

※ EU-Japan Centre for Industrial Cooperation, “Accounting in Japan”

Writer's Pick

Accountant Jobs in Japan for Foreigners

As previously mentioned, there is a demand for accountants with foreign language skills in Japan, whether it is for foreign national customers residing in Japan or international dealings. The accounting field is extremely wide, the broad occupational term “Accountant (会計士, Kaikeishi)” is insufficient to describe the many specialists within the field.

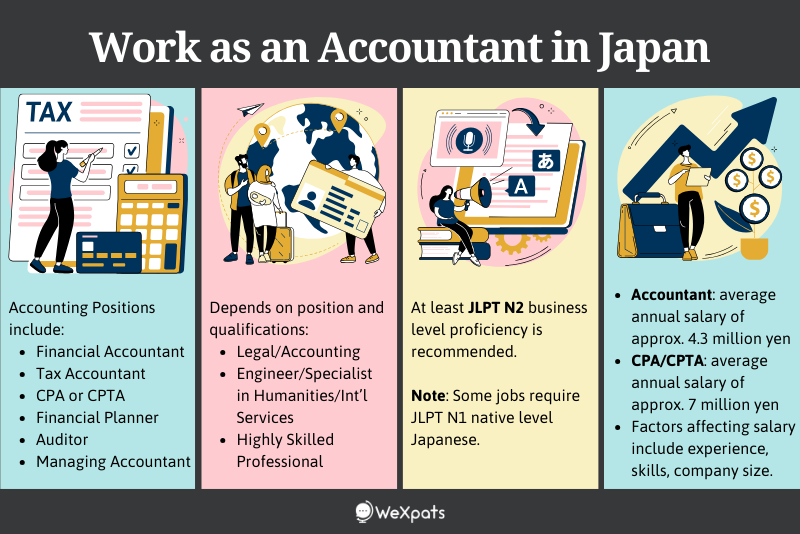

Here are some of the types of accounting positions available in Japan:

- Financial Accountant

- Financial Planner

- Forensic Accountant

- Internal Auditor

- Managerial Accountant

- Tax Accountant

- Bookkeeping

There are also 2 professional occupations in Japan:

- Certified Public Accountant (公認会計士, Kounin Kaikeishi)

- Certified Public Tax Accountant (税理士, Zeirishi)

Workplace Options for Accounting Jobs in Japan

Accountant jobs in Japan for foreigners can be found in various industries and sectors, ranging from multinational corporations to accounting firms, and local businesses.

Accounting Office (会計事務所)

会計事務所 (Kaikei Jimusho), aka “Accounting Office”, specialises in providing accounting services such as bookkeeping, tax consultation, tax return preparation and submission to individuals and corporations. They are established by certified public accountants.

An accounting firm established by at least 5 certified public accountants is called 監査法人 (Kansa Houjin), aka “Auditing Firm” or “Auditing Corporation”. They are also sometimes referred to as “会計事務所”.

Tax Accountant Office (税理士事務所)

税理士事務所 (Zeirishi Jimusho), aka “Tax Accountant Office”, specialises in providing tax accounting services such as tax consultation, but also provide general accounting services like bookkeeping. They are established by certified public tax accountants.

A large-scale tax accountant office established by at least 2 certified tax accountants is called 税理士法人 (Zeirishi Houjin), aka “Tax Accounting Firm”.

Company Accounting Department (経理部)

Japanese companies generally have at least three main departments consisting of general affairs (総務部, Soumu-bu), human resources department (人事部, Jinji-bu), and accounting department (経理部). The main tasks of the accounting department is managing the company’s cash flow and accounts including preparing invoices, creating payroll ledgers, bookkeeping, corporate tax returns, etc.

The extent of an in-house accountant’s task depends on the company size. In addition, industry knowledge may be required depending on the company. For example, accountants in construction companies will need to know the relevant terminology and project timeline to properly handle the company’s accountants.

Check the job details carefully before applying as some job openings may specify existing knowledge of the particular industry. There are many companies that do not require industry knowledge.

Company Labour Department (労務部)

In large companies, just having an accounting department (above) is insufficient to handle all accounting matters, and so a separate 労務部 (Roumu-bu) can usually be found. The main tasks of 労務部 (Roumu-bu), aka “Labour Department”, is dealing with all administrative procedures related to employees. This includes payroll, work attendance, and company rules management, as well as health, pension and employment insurance. This reduces the burden on the otherwise overtasked accounting and general affairs department.

Requirements for an Accountant Job in Japan

Accountants are called 会計士 (Kaikeishi) in Japanese. Look out for this keyword, or accounting-related (会計関連, Kaiken Kanren) jobs when job-hunting for accountant jobs in Japan. Each company or accounting office has its own set of requirements for various positions, but these are the general requirements to become an accountant in Japan.

Education in Accounting, Economics or Finance

An academic background in accounting is required for accounting positions, but other similar degrees such as economics, finance, business, commerce, or even law, are also acceptable by some hiring companies.

Study Accounting in Japan

If you are interested in studying accounting in Japan, there are many prestigious universities including Keio University (Faculty of Economics, Faculty of Business and Commerce) and Chiba University of Commerce (Faculty of Commerce and Economics).

There are also vocational schools where students can earn specialised knowledge to obtain a job. Vocational schools that offer accounting courses include:

- Ohara Gakuen (大原学園): CPA and CPTA Course

- Tokyo IT Programming & Accounting Vocational School (東京ITプログラミング&会計専門学校): 2-Years duration courses in Accounting, Tax Accounting, or Business Accounting

- Kansai Business College (関西経理専門学校): 2-Years duration Accounting course

and more.

High Japanese Language Proficiency

Many accounting jobs require a high level of Japanese proficiency. A minimum of JLPT N2 business-level Japanese is recommended for most jobs, but there are also job openings that have a requirement of JLPT N1 native-level Japanese. This is due to the professional nature of accounting jobs, as well as most accounting jobs having business or administrative environments with the use of many Japanese business terminology, requiring you to work with Japanese colleagues, and perform other business-level Japanese tasks.

Useful Qualification or Certification for Accounting

Some job openings require candidates to have acquired particular qualifications or certifications in accounting. The 日商簿記検定 (Nissho Boki Kentei) bookkeeping test is highly recommended. It is one of the most basic accounting certifications to have in Japan. There are 4 levels - Beginner (初級) and Levels 1 (highest) to 3 (lowest). Getting up to Level 2 (2級) is recommended. There is a chance that your company may even sponsor test costs for you to gain this or other certifications that will come useful for your position.

Other useful accounting-related qualifications and certifications include:

- Japanese Only

- 給与計算実務能力検定試験®: a payroll calculation test

- ビジネス会計検定: a business accounting test

- ファイナンシャルプランナー (FP): a financial planner test

- Finance & Accounting Skill Standard (FASS): a practical skills for working in accounting and finance department test

- Passport for Accounting Skill Standard (PASS): a practical skills for working in accounting test based on the Ministry of Economy, Trade and Industry’s accounting and financial services skill standard

- Certified Public Accountant / Certified Public Tax Accountant (more below)

- English

- U.S. Certified Professional Accountant (CPA): the United State’s CPA professional qualification

How to Become a Professional Accountant in Japan

A professional qualification is not necessary to become an accountant in Japan. But if you are interested in challenging yourself further, then please have a look.

Note: These tests are in Japanese only. You will need at least JLPT N2 level proficiency to understand the content.

Certified Public Accountant (CPA) in Japan

According to the Japanese Institute of Certified Public Accountants (JICPA), the conditions to become a Certified Public Accountant (公認会計士, Kounin Kaikeishi) in Japan are:

- Pass the CPA examinations, known as one of the most difficult professional examinations in Japan

- 2+ years relevant work experience, which can be done before or after the CPA exams

- Completion of 3-years Professional Accountancy Education Program with the Japan Foundation for Accounting Education and Learning (JFAEL)

- Pass the final assessment exam consisting of 5 subjects with JICPA

To practise as a full-fledged CPA in Japan, register as a CPA with JICPA. Check the link below for more information.

※ JICPA, “CPA Profession”

Brief Stop Here : Is my US CPA useful in Japan?

Only Japanese CPAs are recognised in Japan. There are no exemptions for foreign CPA or CA qualifications in Japan.

However, having a foreign CPA or US CPA will be advantageous to you when finding an accounting job in Japan. There are a lot of accounting firms in Japan with international dealings that require English-speaking accountants. Having a CPA certification, even one from overseas, is a huge advantage to you and can prove your accounting prowess to hiring companies.

In fact, many existing foreign accountants in Japan choose to take the US CPA over the Japan CPA.

Certified Public Tax Accountant (CPTA) in Japan

According to the Japan Federation of Certified Public Tax Accountants Associations, to become a Certified Public Tax Accountant (税理士, Zeirishi) in Japan, one must pass the CPTA examination organised by the National Tax Counsel. Attorneys and CPAs are exempted from taking the CPTA examination.

Additionally, some examinable subjects are exempted if certain conditions are fulfilled, such as having graduate school level education in accounting or tax law, or 10+ years working in tax affairs at a government office, etc. Exemptions are evaluated on a case-by-case basis.

To practise as a CPTA, register as a CPTA with the Association, and join the regional Association with jurisdiction over the location of your workplace. Check the links below for more information.

※ Japan Federation of Certified Public Tax Accountants Associations, “Qualifications” ”Examination” ※ Yamaguchi Takashi Tax Accountant Office, “What is a “Zeirishi” – Japanese tax accountant?”

Accountant Salary in Japan

According to the Japanese Ministry of Health, Labour and Welfare’s Basic Wage Survey for the Year 2022, the average monthly salary for accountants (会計事務従事者) is 288,100 yen. For a further breakdown, the average by corporation size is:

- 281,800 yen for businesses with 10~99 employees

- 284,100 yen for businesses with 100~999 employees

- 301,900 yen for businesses with over 1000 employees

The average annual salary (bonus and other allowances included) for accountants is 4,318,900 yen. The average by corporation size is:

- 4,050,600 yen for businesses with 10~99 employees

- 4,273,300 yen for businesses with 100~999 employees

- 4,736,300 yen for businesses with over 1000 employees

How much is CPA and CPTA’s salary in Japan?

Salary for CPA and CPTA are separated from accountants. They are classified as “Professionals (専門)”. According to the results, the average monthly salary for CPA and CPTA (公認会計士・税理士) is 439,000 yen. By corporation size, the average monthly salary is:

- 412,700 yen for businesses with 10~99 employees

- 484,600 yen for businesses with 100~999 employees

- 474,400 yen for businesses with over 1000 employees

The average annual salary (bonus and other allowances included) for CPA and CPTA is 7,012,800 yen. The average by corporation size is:

- 6,930,600 yen for businesses with 10~99 employees

- 7,192,700 yen for businesses with 100~999 employees

- 7,826,800 yen for businesses with over 1000 employees

As you can see, CPA and CPTAs earn on average about 3 million yen more in annual salary compared to accountants. The corporation size and your work experience also makes a big difference to an accountant’s salary in Japan.

※ e-Stat Official Statistics of Japan, “令和4年賃金構造基本統計調査:職種(小分類)別きまって支給する現金給与額、所定内給与額及び年間賞与その他特別給与額(産業計)” [2023.03.17]

Accountant Visa in Japan

There are two status of residence (visa type) options for foreign accountants in Japan depending on your job position and qualifications.

The “Legal / Accounting (法律・会計業務)” status of residence (visa type) is for legally qualified practitioners of law and accounting work, i.e. CPAs and CPTAs. To be eligible for this status of residence, you need to be practising as a CPA or CPTA in Japan.

If the above does not apply, then the “Engineer / Specialist in Humanities / International Services (技術・人文知識・国際業務)” status of residence (visa type) should apply. Accounting work falls under the “Specialist in Humanities (人文知識)” category.

Another option is the Highly Skilled Professional Visa which was introduced in 2012. It is a point-based system visa that allows holders to fast track into getting a permanent visa status if the required points are achieved.

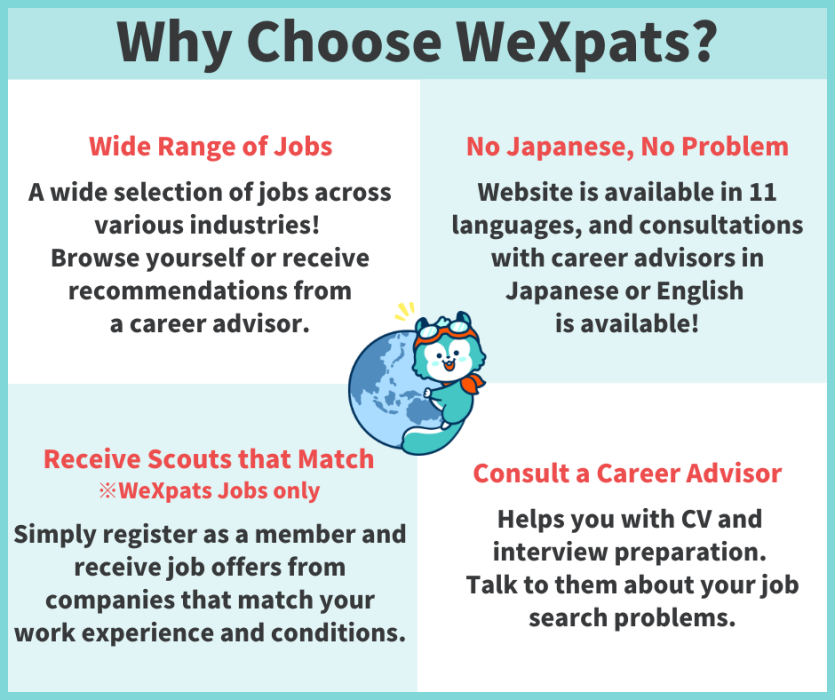

Find a Job in Japan with WeXpats

WeXpats operates a service for foreign nationals who want to work in Japan. There are jobs in a variety of industries including accounting and finance jobs. There are 2 services available on WeXpats - WeXpats Agent for full time jobs and WeXpats Jobs for part time jobs.

Looking for a Full Time Position? Leave it to WeXpats Agent!

WeXpats Agent is a career support service that specialises in employment for foreign nationals living in Japan.

Recruitment agencies in Japan are a service where dedicated career advisors will assist you with your job hunt for free. In addition to introducing open positions, we also provide support to help you create your Japanese resume and practice for interviews. Worried about job hunting in Japanese? We are here for you.

Features of WeXpats Agent

-

We have many job openings that are a good fit for foreign nationals to work in, such as translation, interpretation, inbound, etc. jobs that make use of your language skills, as well as engineering etc. jobs that do not require Japanese skills.

-

Our career advisors support and help you prepare your resume and practice job interviews with you. Clearly communicate your strengths to the hiring company.

-

We will handle communication with companies on your behalf, such as arranging interview dates and negotiating conditions. And thereby reducing your stress and time spent.

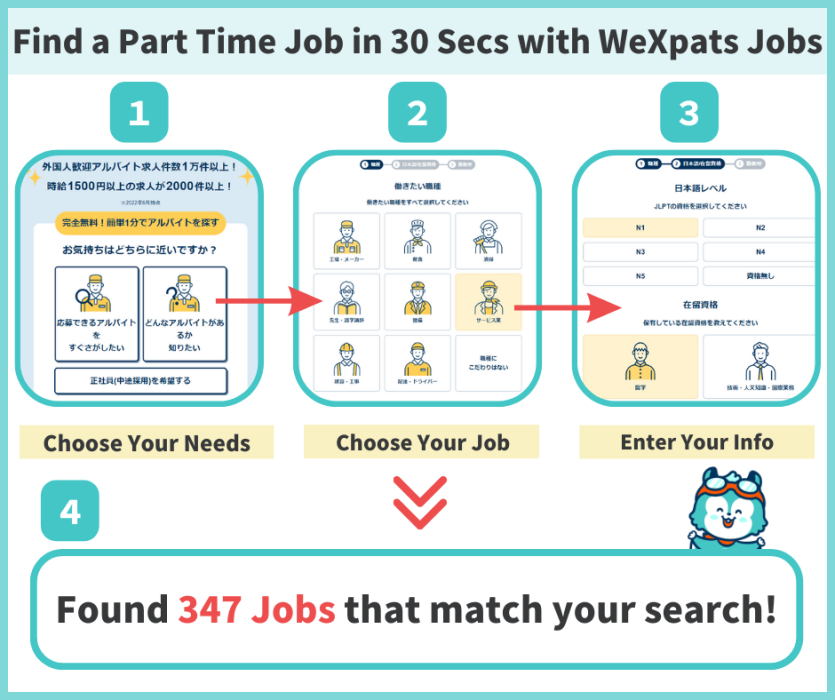

Finding a Part Time Job? Browse on WeXpats Jobs!

WeXpats Jobs is a part time job site for foreign nationals living in Japan. You can search for jobs in 11 languages (English, Vietnamese, Korean, Indonesian, Traditional Chinese, Simplified Chinese, Burmese, Thai, Spanish, Portuguese), including Japanese. Find jobs that suit you by specifying your Japanese language level, occupation, location, and etc.

※ You can register from outside Japan, but only those living in Japan can apply for jobs.