For those who are interested in settling down permanently in Japan, you may be interested in acquiring your own home or apartment. In this article, we introduce how foreign residents can get a housing loan in Japan.

First Published: 2020-09-07

Updated: 2024-07-26

Table of Content

- A Look at Housing Loans in Japan

- Can foreign residents buy real estate in Japan?

- Can foreign residents apply for housing loans in Japan?

- Requirements for Housing Loans in Japan

- Procedure for Taking out a Housing Loan in Japan

- How to Get a Housing Loan in Japan without Permanent Residency

- Housing Loan Deduction to Reduce Tax Burdens

A Look at Housing Loans in Japan

A housing loan or home loan, also known as a mortgage, is called “住宅ローン (Juutaku Ro-n)” in Japanese.

What is a housing loan?

A housing loan is money borrowed from a bank or financial institution to buy residential property. The money borrowed is repaid over a long-term period. The repayment includes the principal (original sum borrowed) and interest (cost of borrowing).

Housing loans in Japan can be divided according to type of lender, type of interest rate, and repayment method.

Types of Housing Loan Provider in Japan

- Private Financial Institution (民間の金融機関) - Private housing loans provided by banks, credit unions, labour banks, etc. Majority of housing loans are from private financial institutions. The advantage of private financial institutions is that you can receive a preferential rate if you have an existing account. Other benefits such as life insurance coverage, preferential car loan rates may also be offered.

- Public Financing (公的融資) - Public loans provided by public institutions such as local governments. These public loans are to assist residents with acquiring a home, and so offer relatively low interest rates. The eligibility criteria for these loans usually include being a resident of the area, and having an income below a certain level.

- Flat 35 (フラット35) - Flat 35 is a fixed-rate mortgage provided by the Japan House Financing Agency (住宅金融支援機構). The residential property you are intending to purchase must fulfil certain conditions to be eligible for the loan.

Types of Housing Loan Interest Rates in Japan

- Full Term Fixed-Rate Interest (全期間固定金利) - interest rates are fixed for the entire loan period

- Select Period Fixed-Rate Interest (固定金利期間選択) - interest rates are fixed for a certain period of time, after which you can choose between fixed-rate or floating-rate interest

- Floating-Rate Interest (変動金利) - interest rates fluctuate based on market conditions

Types of Housing Rate Repayment Method in Japan

- Equal Principal and Interest Repayment (元利均等返済) - fixed monthly payments that consists of a balance of both principal and interest, the amount of repayment is the same throughout the loan period

- Equal Principal Repayment (元金均等返済) - a fixed amount of principal is paid added with amount of interest on the balance, the interest amount decreases as repayment progresses, so the monthly repayment amount decreases each time

Writer's Pick

Can foreign residents buy real estate in Japan?

Yes, foreign residents can buy real estate (apartment, house, land, etc.) in Japan provided they have the funds and satisfy the purchase conditions for it. Taxes, such as property tax, gift & inheritance tax, etc., that apply are also at the same rate by local Japanese citizens.

Can foreign residents apply for housing loans in Japan?

Yes, provided they meet the conditions for a housing loan set by the lender, foreign residents are also eligible for housing loans in Japan.

An important condition for getting a housing loan in Japan is having permanent residency. Most financial institutions list “permanent residency” as a prerequisite for providing housing loans to foreign residents.

Requirements for Housing Loans in Japan

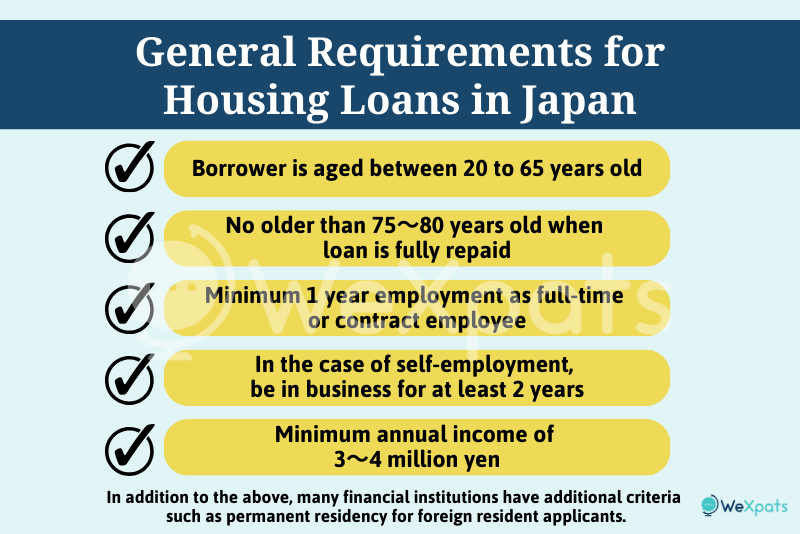

When applying for a housing loan, you need to meet the conditions set by each financial institution. The requirements vary for each financial institution, but generally the borrower must fulfil the following conditions:

- Is between 20 to 65 years of age

- Will be no older than 75~80 years of age when the loan is fully repaid

- Employed as a full-time or contract employee for at least 1 year

- In the case of self-employed, be in business for at least 2 years

- Minimum annual income of 3~4 million yen

And, as mentioned above, many financial institutions have additional criteria for foreign resident applicants. For example, having “permanent residency”. If you have a permanent resident status, then the process to get a housing loan will be the same as for any other local Japanese resident.

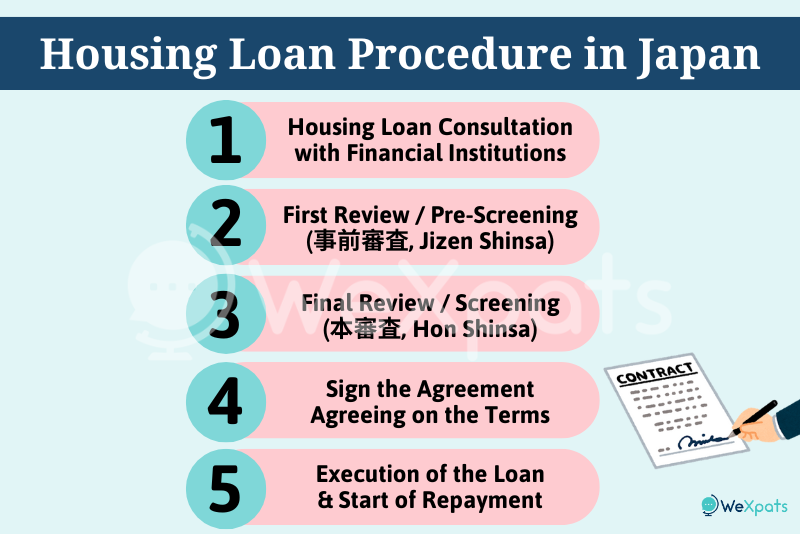

Procedure for Taking out a Housing Loan in Japan

After deciding on the property you want to purchase, it is time to apply for a housing loan. Here is the basic procedure of taking out a housing loan in Japan.

1. Housing Loan Consultation

Make a reservation with a financial institution (e.g. bank) for a mortgage consultation. Banks usually have a dedicated department that specialises in housing loans.

What should you discuss?

- How much can you borrow?

- How much is the interest rate?

- What is the repayment period? How many years?

- What type of housing loans are available?

- What is the penalty for late payments?

- What documents are required?

- How long does it take for the housing loan to be granted?

- What to do if you are having difficulty with repayments?

What should you bring?

Though not strictly necessary, bringing along the following documents will help the mortgage consultant give you more specific advice and suggestions on suitable financial products.

- Withholding Tax Slip (源泉徴収票), or Tax Return (確定申告書) for self-employed

- Certificate of Year-End Balance of Other Existing Loans

- Pamphlet or Information of Property to be Purchased

- Draft Sale and Purchase Agreement of Property to be Purchased

2. First Review / Pre-screening (事前審査, Jizen Shinsa)

After the consultation and having decided on a housing loan plan, it is time for the first review or pre-screening.

What documents to submit?

- Personal ID

- Documents to Prove Income (withholding tax slip, tax payment certificate, tax return form, etc.)

- Existing Loan Documents (certificate of year-end balance on loans, credit card statements, etc.)

- Pamphlet or Information of Property to be Purchased

3. Final Review / Screening (本審査, Hon SHina)

Only those who have passed the first review (pre-screening) can proceed with the final review / screening. This process usually takes 1 month or more to complete. Even if you pass the first review, there is no guarantee that you will pass the final review. The results of the final review are final, if it falls through, then you will have to apply with a different financial institution.

During this stage, the applicant is screened for:

- Repayment Ratio (ratio of loan repayment amount to annual income)

- Attributes (age, occupation, family composition, etc.)

- Existing Loan Situation (credit card situation, repayment status of loans, number of loans held, etc.)

The value of the property is also evaluated.

4. Sign the Housing Loan Agreement

If you pass the final review, then the next step is to sign the housing loan agreement which will be prepared by the bank. Confirm the loan amount, repayment period, interest rate and fees before signing. You won’t need any documents, but your personal seal is required. Be careful not to miss the deadline to conclude the agreement.

5. Execution of Loan and Settlement

Once the agreement is completed, the loan will be executed. All you need to do is to wait for the money to be transferred to the designated account on the date that was agreed upon. Generally, the loan will be executed at the same time when property is handed over. Your repayment period will begin.

How to Get a Housing Loan in Japan without Permanent Residency

Foreign residents who do not have permanent residency in Japan have a hard time getting a housing loan in Japan because financial institutions are concerned about the risk that they may return to their home country resulting in non-payment or delayed repayment. However, there are still ways for foreign residents without permanent residency to get a housing loan in Japan, which we will introduce below.

Prepare a Large Down Payment

It is said that it is easier to take out a housing loan if you prepare a large down payment. The general guideline for down payments is “20% the price of the property to be purchased”. Therefore, if you are a foreign resident without permanent residency planning to take out a housing loan, it is better to prepare a down payment of about “25~30% the price of the property to be purchased”.

Have Your Spouse Act as Guarantor

If your spouse is a Japanese citizen or has the status of “permanent resident”, it is possible to get a housing loan with him/her acting as guarantor.

Use a Bank From Your Home Country

If a bank from your home country has a branch in Japan, it may be possible to apply for a housing loan there. Since the bank operates in the borrower’s home country, it is easier to keep track of the borrower. It will be easier if you have an existing account with the bank. The bank may also allow repayments in your home country’s currency.

Apply for a Housing Loan for Foreign Residents without Permanent Residency

Some financial institutions offer housing loans to foreign residents without permanent residency but with additional criteria. Usually, the interest rate is set slightly higher and a guarantor is required, but at least you are eligible for it. The conditions and screening procedures vary for each financial institution, so check carefully.

Housing Loan Tax Deduction to Reduce Tax Burdens

“Housing Loan Tax Deduction (住宅ローン控除)” is a system to reduce the tax burden of people who are repaying a housing loan. Under this system, those who have taken a housing loan to build, buy or renovate a home can deduct 0.7% of the housing loan balance from their income tax for up to 13 years. If the amount cannot be deducted from income tax, it can be deducted from the next year’s resident tax instead.

Conditions for Housing Loan Tax Deduction

The conditions to be eligible for the Housing Loan Tax Deduction are as follows:

- The property is for self-living residential purposes, or at least 1/2 is for residential purposes

- The total floor area must be at least 50m2

- The housing loan period is at least 10 years or more

- Occupancy must be within 6 months of handover or completion of construction

- Total annual income is 20 million yen or less

In addition to the above, other applicable conditions may apply depending on the type of housing. For example:

- Newly constructed homes certified after January 2024 must meet certain energy-conservation standards.

- Purchase and resale homes must be more than 10 years old.

- Must meet certain earthquake-resistant standards before occupancy.

Please check the conditions properly when applying.

How to Apply for Housing Loan Tax Deduction

The Housing Loan Tax Deduction is claimed by filing an annual tax return called 確定申告 (Kakutei Shinkoku). You will need to fill-in and submit the “Details of Calculation of Special Deduction for Housing Loans, etc. (住宅借入金等特別控除額の計算明細書)”.

Company employees do not usually need to do a tax return as their income tax is withheld by the company. However, you will need to do a tax return to claim the Housing Loan Tax Deduction in the first year that you are eligible for it. Tax returns are filed between February 16th till March 15th each year.

There are 2 ways you can file a tax return:

- Tax Office (in-person; bring the necessary documents)

- e-Tax (online; electronic filing)

You will need to submit the following documents:

From Legal Affairs Bureau

- Certificate of Real Property Registration (建物・土地の登記事項証明書)

From Financial Institution (housing loan provider)

- Certificate of Housing Loan End-of-Year Balance (住宅ローンの残高証明書)

From Real-Estate Company

- Copy of Sale and Purchase Agreement (建物・土地の不動産売買契約書(請負契約書)の写し)

- Copy of Earthquake Resistance Certificate or Housing Performance Evaluation Report (for used homes that meet earthquake resistance standards)

- Copy of Home Performance Certificate (for long-term quality housing, low-carbon housing, and energy-saving housing)

You only need to file the tax return once in the first year. From the second year onwards, the housing loan tax deduction will be applied through your employee’s year-end tax adjustment (年末調整, Nentmatsu Chousei) though you will need to furnish them with the following documents:

- Certificate of Housing Loan End-of-Year Balance (住宅ローンの残高証明書) from financial institution (housing loan provider)

- Certificate of Special Deduction for Housing Loans etc. for Year-End Adjustment… (年末調整のための住宅借入金等特別控除証明書兼給与所得者の住宅借入金等特別控除申告書) issued by the tax office in the first year

※ MLIT, “住宅ローン減税” ※ MUFG, “【2024年版】住宅ローン控除(減税)とは?変更点や確定申告の流れを解説!” [2024.03.29]

To Close

Buying a residential property in Japan could be the next step to permanently residing in Japan. For those planning to live long-term in Japan, it is worth comparing the cost of a rental property versus monthly housing loan repayments for your own home. There are many advantages of owning your own home in Japan, for example you are free to make renovations and changes to the home plus no contract renewal fees. Weigh the pros and cons before deciding whether it is worth making such a big purchase, and if you do decide to go ahead, we hope this article makes for a good reference.