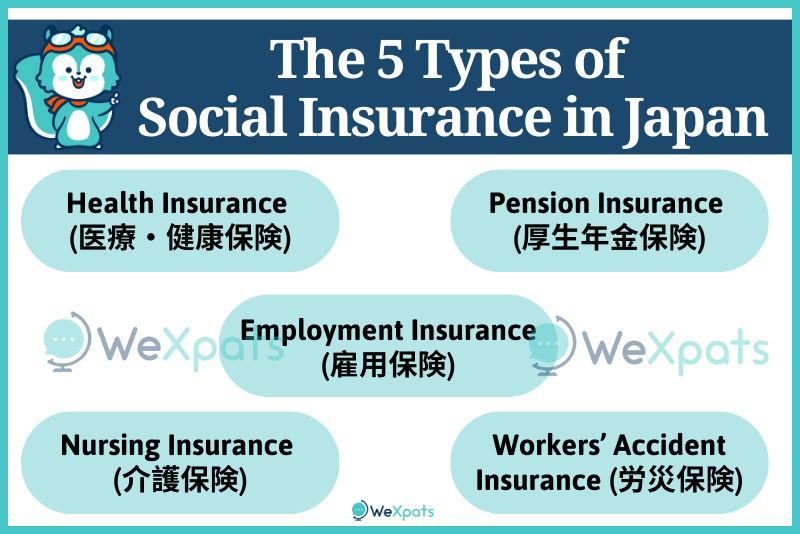

There are 5 types of social insurance in Japan classified under Shakai Hoken (社会保険). The 5 insurances are health, pension, employment, workers’ accident compensation and nursing insurances.

Is Shakai Hoken only applicable for Japanese citizens? No, of course not. Social insurances in Japan are applicable to all long-term residents in Japan regardless of nationality. You can participate in the insurance as long as you meet the applicable requirements.

In this article, we introduce the 5 types of Shakai Hoken there are in Japan and what they entail. We also introduce the “Lump-Sum Withdrawal Payment” and “Social Security Agreement” system for foreign residents in Japan who are worried that they will lose money by paying social insurance premiums.

Table of Contents

- Japan’s Social Insurance System, Foreign Residents Must Join Too!

- What is Shakai Hoken? The 5 Types of Social Insurance in Japan

- Can I withdraw my pension funds? What is the “Lump-Sum Withdrawal Payment”?

- “Social Security Agreement” to Prevent Double Payments for Foreign Residents

- Social Insurance Status Affects Your Status of Residence (Visa)

Japan’s Social Insurance System, Foreign Residents Must Join Too!

Japan’s social security system includes the social insurance system that provides benefits to people who face certain events. Specific events include illness or injury, work-related accidents, childbirth, death, unemployment, and need for nursing care. Benefits under the social insurance system are based on the principle of non-discrimination without distinguishing citizenship status, so foreign nationals are also eligible for benefits.

In Japan, you cannot opt out of the social insurance system. All residents of Japan are required to participate in the appropriate social insurance and pay insurance premiums. The social insurance system in Japan is a public system based on mutual aid, meaning that those who can afford to pay help support those who are facing difficulties. It is important to understand the purpose of this system and to pay contributions correctly.

※ For foreign residents, anyone who stays in Japan for more than 3 months must participate in health insurance to reduce the burden of medical expenses.

Writer's Pick

What is Shakai Hoken? The 5 Types of Social Insurance in Japan

Shakai Houken (社会保険) means “social insurance” and is used to refer to the following 5 types of social insurances in Japan:

- Health Insurance (医療・健康保険)

- Pension Insurance (厚生年金保険)

- Employment Insurance (雇用保険)

- Workers’ Accident Insurance (労災保険)

- Nursing Insurance (介護保険)

As mentioned before, these apply to all residents of Japan regardless of citizenship status. As long as the insurance is applicable to your case, you must participate in it.

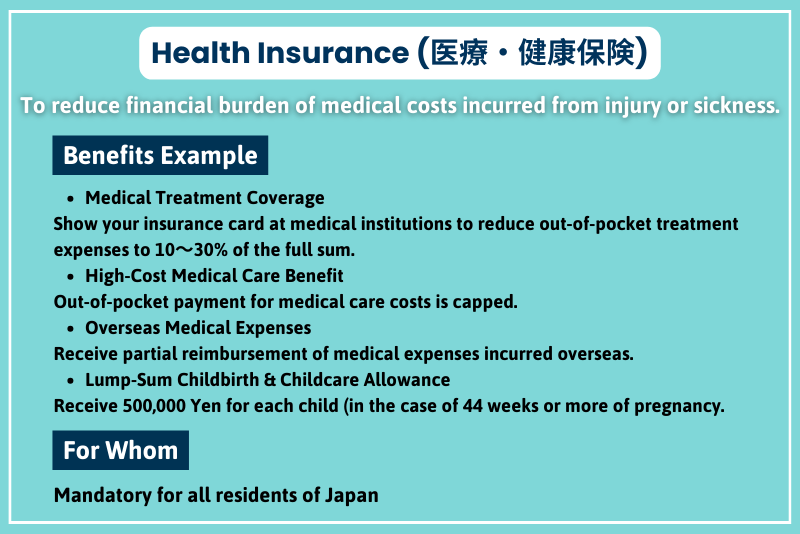

1. Health Insurance / 医療・健康保険 (Mandatory for All)

- Health Insurance / 医療保険 (Iryou Hoken)・健康保険 (Kenkou Hoken)

- Mandatory for all residents of Japan

Health insurance is a system that reduces the financial burden of medical costs incurred from injury or sickness. By joining health insurance and routinely paying insurance premiums, you can reduce your financial burden and focus on recovering your health. The most common benefit from health insurance is “medical treatment payment”. By showing your insurance card at the medical institution you are to receive treatment at, you can reduce your out of pocket expenses to 10~30% of the full sum.

There are several types of health insurance offered by different institutions:

- Employees’ Health Insurance (健康保険)

- National Health Insurance (国民健康保険)

- Benefit Society (共済組合)

- Seamen’s Insurance (船員保険)

Generally, if you are working for a company, you will join Employees’ Health Insurance (Kenkou Hoken) or whatever insurance the company is signed-up to. And, if you are an international student or self-employed person, then you will join National Health Insurance (国民健康保険, Kokumin Kenkou Hoken) which is available through your local municipality’s office.

For company insurance, it will be automatically deducted from your monthly salary. Whereas for National Health Insurance, you will need to make monthly payments yourself.

Read more about receiving medical help in Japan here.

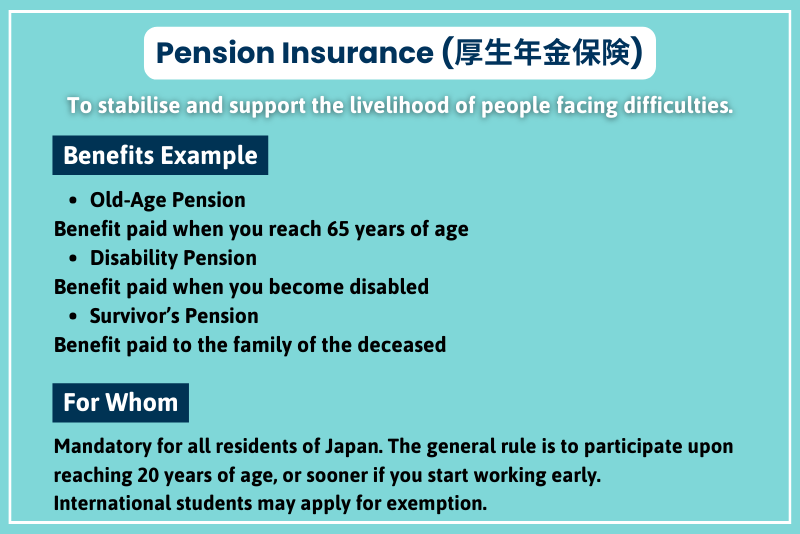

2. Pension Insurance / 厚生年金保険 (Mandatory for All)

- Pension Insurance / 厚生年金保険 (Kousei Nenkin Hoken)

- Mandatory for all residents of Japan. General rule is to participate upon reaching 20 years of age, or sooner if start working earlier.

Pension Insurance is a system that helps stabilise and support the livelihoods of people facing troubles. There is:

- Old-Age Pension / 老齢年金: guaranteed benefits paid to the elderly upon reaching 65 years of age

- Disability Pension / 障害年金: benefits paid to those who are suffering from disability

- Survivor’s Pension / 遺族年金: benefits paid to the bereaved family when the insured passes away

Pension Insurance and the aforementioned Health Insurance come in a set. Participants of Employees’ Health Insurance (健康保険) join Employees’ Pension Insurance (厚生年金), and participants of National Health Insurance (国民健康保険) join National Pension Insurance (国民年金). Those who have paid into pension insurance for 10 years or more are eligible to receive pension upon reaching 65 years of age. It is a system whereby the more you contribute, the more you will receive.

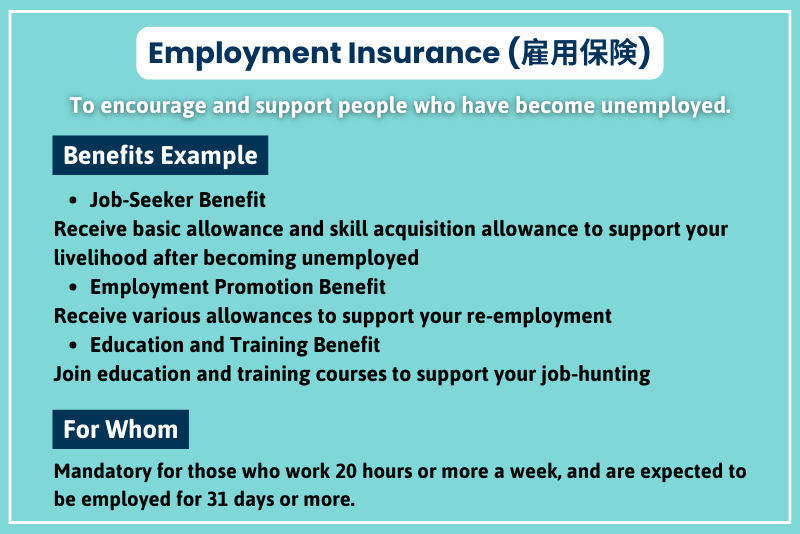

3. Employment Insurance / 雇用保険 (Mandatory if Conditions Apply)

- Employment Insurance / 雇用保険 (Koyou Hoken)

- Mandatory for those who work 20 hours or more a week and are expected to be employed for 31 days or more.

Employment Insurance is mandatory for those who fulfil the following 2 conditions:

- Work for 20 hours or more a week

- Expected to be employed for 31 days or more

The most important benefit provided by Employment Insurance is the “Job-Seekers Benefit”, otherwise known as “Unemployment Allowance”. The “Job-Seekers Benefit” is paid to support and encourage the re-employment of unemployed persons who are willing to work but have trouble finding a job.

Other benefits offered by the Employment Insurance include education and training benefits and employment promotion benefits.

※ Foreign nationals on Working Holiday visa do not need to join Employment Insurance. This is because the purpose of a working holiday is for “holiday” not “work”.

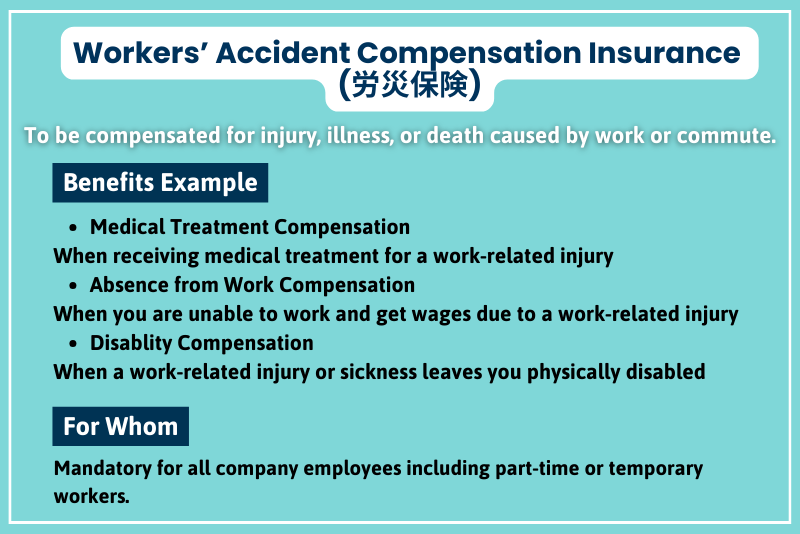

4. Workers’ Accident Insurance / 労災保険 (Mandatory for Companies)

- Workers’ Accident Insurance / 労災保険 (Rousai Hoken)

- Mandatory for all companies’ employees including part-time and temporary workers.

Workers’ Accident Insurance is mandatory for all workers employed by a company, and the company is responsible for paying the insurance premiums. Workers’ Accident Insurance is paid when an employee suffers a work-related accident, injury or death, including during work commute. The benefits include compensation for medical treatment, allowance for absence from work, and etc. The insurance applies to all workers of the company including part-timers and temporary workers.

It is illegal for a company to not acknowledge an injury sustained at work and to not provide benefits or compensation under the Workers’ Accident Insurance. Foreign workers who are not knowledgeable about Workers’ Accident Insurance are prone to becoming targets of “労災隠し (Rousai Kakushi) - when a company conceals a workplace accident to avoid insurance claim”, so practice caution.

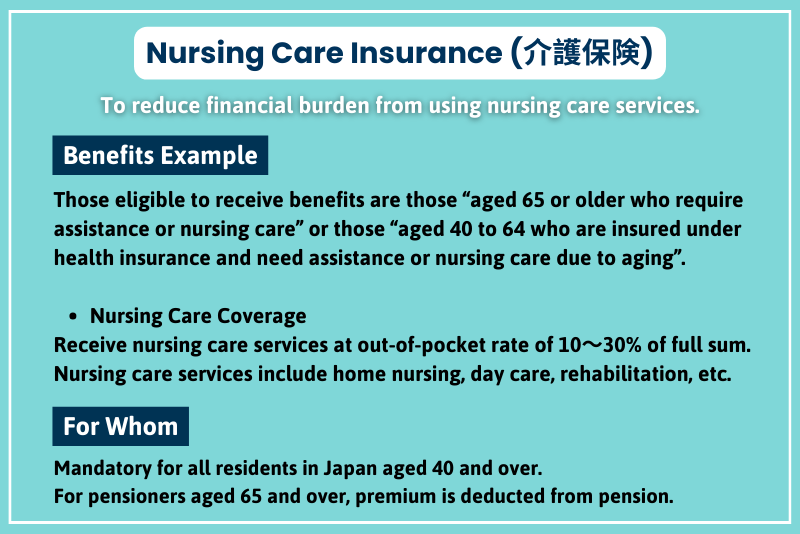

5. Nursing Care Insurance / 介護保険 (Mandatory for 40 and Above)

- Nursing Insurance / 介護保険 (Kaigo Hoken)

- Mandatory for all residents in Japan aged 40 and above

Nursing Insurance is a system that helps reduce the financial burden of using nursing care services. It is mandatory for all residents in Japan from the age of 40 and onwards. Benefits under Nursing Insurance are available to 2 groups of people:

- Those aged 65 and above who are in need of nursing care and support

- Those aged 40 to 64 who are recognised to be in need of nursing care and support due to ageing

Those who satisfy the conditions to receive benefits are eligible for nursing care services at 10~30% of the full sum.

Can I withdraw my pension funds? What is the “Lump-Sum Withdrawal Payment”?

“What happens to my pension when I leave Japan?” is a question that many foreign residents are concerned about. In this part, we will introduce the “Lump-Sum Withdrawal Payment” system that deals with this issue.

What is the “Lump-Sum Withdrawal Payment”?

Japan’s Pension Insurance (年金保険) requires at least 10 years of contributions in order to receive pension payouts. For foreign residents who return to their home countries and leave Japan for good before 10 years are up, this means that their pension contributions end up being a complete waste.

To prevent such a situation, the “Lump-Sum Withdrawal Payment (脱退一時金, Dattai Ichijikin)” was introduced, which allows for a portion of pension contributions to be claimed within 2 years of leaving Japan.

Conditions for the “Lump-Sum Withdrawal Payment”

Foreign nationals registered with the National Pension Insurance and Employees’ Pension Insurance can claim Lump-Sum Withdrawal Payment if they meet the following requirements:

- Not a Japanese national

- Number of months of the National Pension contribution-paid period, or number of months of the Employees’ Pension enrollment period is 6 months or more

- Do not have an address in Japan

- Never eligible to receive pension (including disability benefits)

- Do not meet the qualifications for reaching old-age pension

If you meet all the requirements, you can file a claim within 2 years of no longer residing in Japan.

The method of calculation for “Lump-Sum Withdrawal Payment” differs depending on the type of pension insurance participated.

National Pension Insurance (国民年金)

Calculated with the formula:

“total amount of insurance premiums for the year the last monthly payment of insurance premium was paid” x 1/2 x “number used for calculation of the payment amount (from table)”

The aforementioned table is available on the Japan Pension Service’s website here.

Employees’ Pension Insurance (厚生年金)

Calculated with the formula:

“average standard remuneration of the insured period” x “Payment Rate (from table)”

The aforementioned table is available on the Japan Pension Service’s website here.

Income Tax on “Lump-Sum Withdrawal Payment”

Lump-Sum Withdrawal Payment from Employees’ Pension Insurance (厚生年金) is subject to income tax at the rate of 20.42% that is withheld at the time of payment. You may apply for a tax refund by submitting a “Tax Return for Refund Due to Taxation on Retirement Income at the Taxpayer's Option" and “Notification of Tax Agent for Income Tax/Consumption Tax" to the tax office with jurisdiction over your last place of residence in Japan.

Income tax for Lump-Sum Withdrawal Payment from National Pension Insurance (国民年金) is not withheld.

“Social Security Agreement” to Prevent Double Payments for Foreign Residents

“Do I need to pay social insurance (pension) in my own country too?” you may wonder as a citizen of another country residing in Japan. In this part, we explain the “Social Security Agreement”, a bilateral agreement on social insurance for foreign residents in Japan.

What is a “Social Security Agreement”?

Social Security Agreements (社会保障協定, Shakai Hoshou Kyoutei) are bilateral agreements between Japan and another country to prevent double payment or wasted payment of pensions. Under the agreement, foreign nationals dispatched to Japan by companies in foreign countries that have a social security agreement in Japan can either pay pension premiums in their home country or Japan. Which pension to pay depends on the contents of the agreement between the two countries and the length of stay in Japan.

Between countries with social security agreements, it is possible to combine the pension contribution periods. Foreign nationals dispatched by companies in countries with social security agreements can receive pension funds if they have paid pension insurance in their home country and in Japan for a total of at least 10 years.

However, note that the pension contribution periods cannot be combined for the purpose of claiming lump-sum withdrawal payment. In addition, social security agreements do not apply to foreign nationals employed locally in Japan.

Countries that Have Social Security Agreements with Japan

As of March 8th, 2024, the following 23 countries have Social Security Agreements with Japan.

- Australia

- Belgium

- Brazil

- Canada

- China

- Czech Republic

- Finland

- France

- Germany

- Hungary

- India

- Ireland

- Italy

- Luxembourg

- Netherlands

- Philippines

- Republic of Korea

- Slovak Republic

- Spain

- Sweden

- Switzerland

- United Kingdom

- United States

※ Japan Pension Service, “それぞれの国(くに)との協定(きょうてい)の状況(じょうきょう)/Status of agreements with other countries” [2024.03.08]

Social Insurance Status Affects Your Status of Residence (Visa)

Status of participation and contribution in social insurance may affect status of residence. There is no clear rule or provision that participating in social insurance is a prerequisite for getting your application to change or extend status of residence approved. However, it has become mandatory to show your insurance card when applying for change or extension of status of residence.

In addition, when it comes to applying for permanent residency in Japan, applicants are required to show proof of tax and social insurance payments. Delayed or non-payment of tax and social insurance is said to affect the results of applications.

With the increase of foreign residents in Japan, there is a possibility that regulations and screening will become stricter in the future. In recent news, the government has begun considering amending the law to allow revocation of permanent residency status for those who fail to pay taxes or social insurance premiums. Therefore, make sure to pay your social insurance premiums in a timely manner.

※ ISA, “在留資格の変更,在留期間の更新許可のガイドライン” [Revised February 2020] , “出入国在留管理基本計画” ※ Asahi Shimbun, “税や保険料を納めない永住者、許可の取り消しも 政府が法改正を検討” [2024.02.05]

To Close

Social insurance, aka Shakai Hoken, in Japan does not discriminate by nationality but is based on residency. Both Japanese locals and foreign residents are required to participate in social insurance provided the conditions are fulfilled.

Japan’s social insurance is based on the principle of mutual aid where we all help one another. Understand the purpose of the system and how it works and you will come to appreciate it and not feel it is a waste and merely an obligation to be fulfilled.